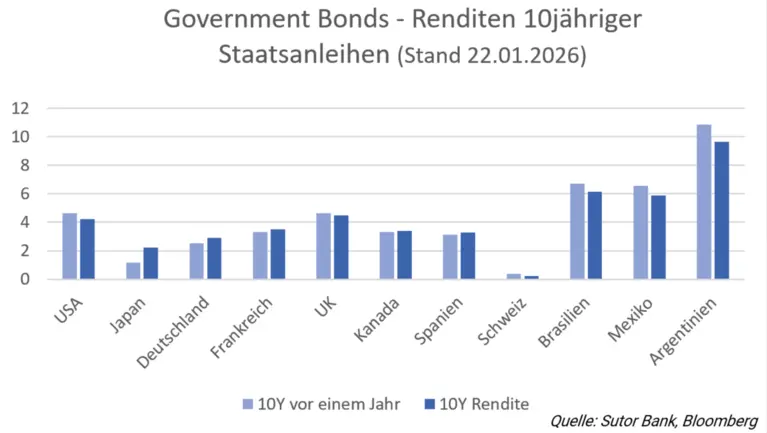

The situation on the markets is still tense. The Fed's interest rate decision was necessary, but its effect remains limited. "Investors have therefore sought additional security within the safe havens in recent days," says Mathias Beil, Head of Private Banking at Hamburg-based Sutor Bank. "Only genuine credit ratings have been able to benefit here, and interest rate differentials are growing."

The US Federal Reserve had little choice but to actually carry out the announced interest rate hike. "Waiting would have only fueled speculation about further difficulties at US banks," says Beil. The fact that this decision did not please everyone was also reflected in the differences in interpretation between the Fed and the US Treasury. Although these were only minimal, the fact that they were visible at all was perceived by the markets as a sign of uncertainty.

However, it was important to both of them that another bank run must be prevented at all costs. The markets are nowhere near as stable as everyone had hoped. "In this situation, it is clear that investors are going for extreme safety," says Beil. "Ten-year German government bonds were in demand and prices rose significantly." Bonds from southern European countries were completely different. The difference in yields widened more and more. The situation was similar when comparing other bonds from the government sector with corporate bonds.

The widening of spreads between all these areas does not bode well for the coming weeks. The ECB still has to step up its interest rate hikes, while the peak will soon be reached in the US. "This could result in a stronger euro, both against the US dollar and against other currencies, especially the Swiss franc," says Beil. "The Swiss franc has lost much of its aura as a crisis currency in the wake of the Credit Suisse crisis."