Profit from the capital market and grow your wealth

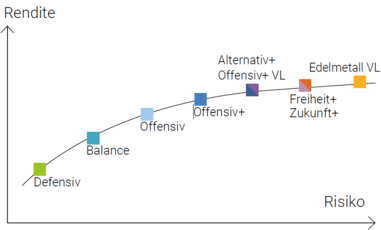

Anyone can invest in the performance of the capital market to build up long-term wealth. Equity and bond funds and ETFs offer you a wide range of options for investing your money. Some people want to invest a large sum at once, others want to save a small amount each month. Some want to make provision for old age. Perhaps you are also looking for a flexible solution? The Sutor Bank is always the right choice for you: with or without state subsidies, as a self-investor or with asset management.

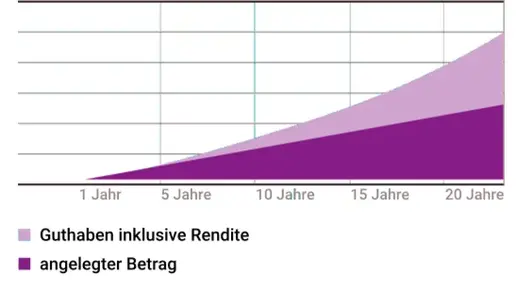

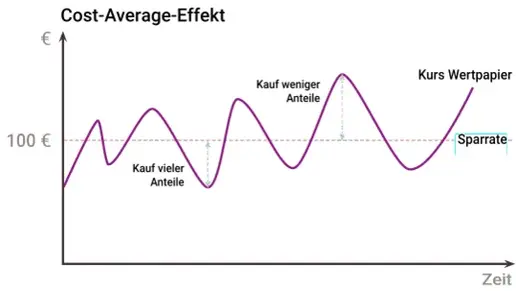

A good option for investing in the capital market is a savings plan, for example, through which regular payments are made into equity or bond funds. This allows you to build up a securities portfolio over the long term. Before deciding in favour of one investment or another, you should weigh up the costs, return and risk as well as personal factors.

But be careful: don't invest in anything you don't understand. When investing in securities, it is generally true that the riskof suffering losses with the investment increases with the potential returns. If you are unsure, you should seek advice before investing or appoint an asset management team to look after your investment portfolio.

It's actually quite simple: with a well-diversified mix of investment funds with shares or bonds, you can participate in the capital market. In the long term, investors who want to achieve solid returns cannot ignore equities. The longer you stay invested, the more likely it is that fluctuations on the stock market will be evened out.