According to expert estimates, listed stock corporations in Germany are set to pay out a record dividend in 2024. The lion's share of dividends will be paid out by DAX companies, totalling around 53 billion euros, according to a study by DSW. So is the issue of dividends just a question of company size? ‘A look at the absolute figures suggests that it is,’ says Mathias Beil, Head of Private Banking at Hamburg-based Sutor Bank. ‘But smaller companies also offer attractive dividends - and diversification for the portfolio.’

At around 63 billion euros, the companies in the DAX, MDAX and SDAX are paying out 1.6 per cent more than in the previous year. As a brief analysis by Sutor Bank shows, the share of dividends in the overall performance of the DAX is very high - but the share of dividends in the overall performance of the SDAX is also significant. ‘Dividends don't just flow in the DAX. Dividends can also significantly boost performance in segments such as the SDAX and thus make a major contribution to investment success. Investors should therefore not just look at the DAX when it comes to dividends,’ explains Mathias Beil.

2024: Many dividend payers also in the MDAX and SDAX

The DSW dividend study also shows that, although 88 per cent of DAX companies pay dividends in percentage terms, this figure is not significantly lower for the MDAX at 76 per cent and the SDAX at 79 per cent. ‘The absolute amount of dividend payments reflects the international market position of many DAX companies. This also makes them less dependent on the domestic economy than smaller companies,’ says Mathias Beil.

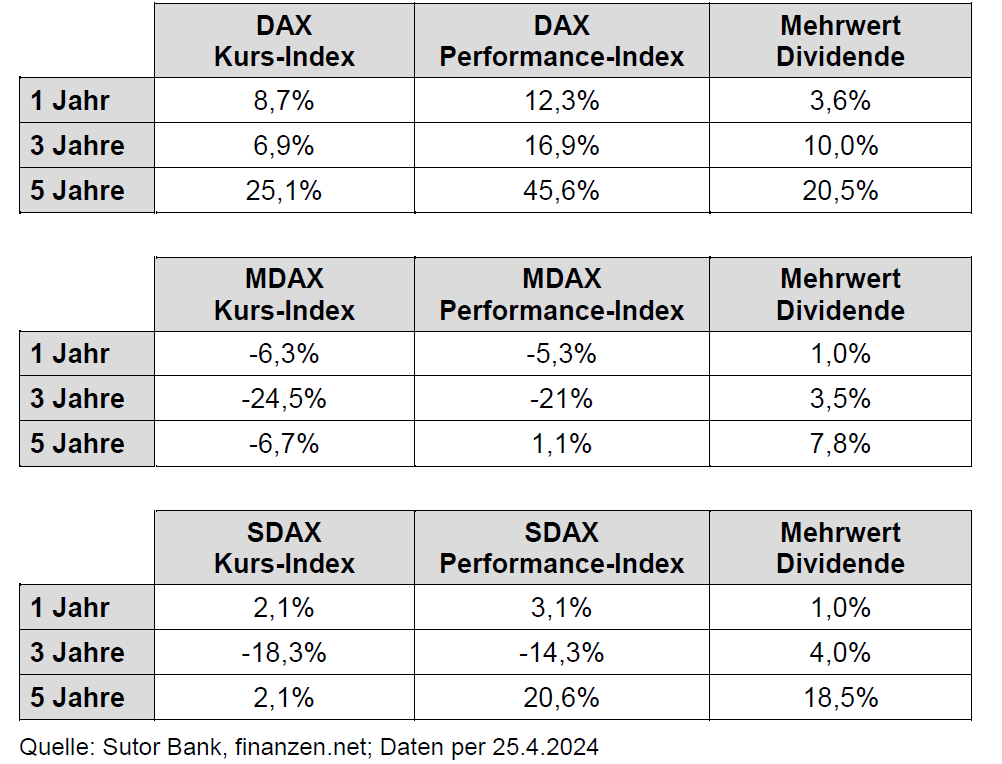

Sutor Bank analysed the added value of dividend payments in the three indices DAX, MDAX and SDAX over one, three and five years. To do this, Sutor Bank compared the price index (without dividends) with the performance index (with dividends). The result shows that SDAX companies have generated 18.5 percentage points or almost a fifth of their overall performance over five years through dividends. This is only slightly less than for DAX companies, where dividends account for 20.5 percentage points of the performance over the last five years. Only the MDAX lags far behind, with dividends accounting for only 7.8 percentage points of total performance over five years.

From a short-term perspective, the DAX is more clearly ahead: over a one-year period, the added value of dividends amounts to 3.6 percentage points, compared to only 1.0 percentage points for the MDAX and SDAX. Over a three-year period, dividends account for 10.0 percentage points for the DAX, while the proportion is significantly lower for the MDAX (3.5 percentage points) and SDAX (4.0 percentage points).

‘Dividend payments can make a significant contribution to the overall performance of shares. For risk reasons, however, it is advisable not to focus on individual shares, but rather to invest index-related, for example. The analysis shows that dividends can make a considerable contribution to returns in the long term, not only in the DAX, but also in the SDAX, for example,’ summarises Mathias Beil. It is therefore worth diversifying shares across different segments and including smaller companies in the portfolio.

![[Translate to English:] Deutsche Flagge vor dem Bundestag](/fileadmin/_processed_/6/8/csm_maheshkumar-painam-HF-lFqdOMF8-unsplash_fde0da4c98.webp)